Introduction

Before selling land in Arkansas, it’s smart to find out whether your property lies in a flood zone.

Flood-zone status can affect insurance, financing, and even the type of buyer you attract. Many landowners don’t realize their parcel sits in a designated floodplain until a buyer’s title company or lender points it out.

At Shamrock Lands (501-406-0051), we buy all types of Arkansas land — including properties in or near flood zones. Here’s how to check your parcel, what those FEMA maps really mean, and how flood status can influence your sale.

Why Flood Zones Matter

A flood zone is an area identified by the Federal Emergency Management Agency (FEMA) as having a certain level of flood risk.

Buyers, lenders, and insurers use this classification to decide:

- Whether flood insurance is required

- Whether financing is available

- How buildable or developable the land is

Even vacant land can be affected. Builders often avoid high-risk zones because raising elevations or installing drainage can be costly.

Types of Flood Zones in Arkansas

| Zone | Description | Typical Impact |

|---|---|---|

| Zone X | Minimal flood risk | Usually safe for building and financing |

| Zone AE / A | 1% annual chance of flooding (100-year floodplain) | Flood insurance required for loans |

| Zone AO / AH | Areas of shallow flooding or ponding | May require elevation certificates |

| Zone VE | Coastal flood zone (rare in Arkansas) | High insurance cost; often undevelopable |

Most flood-zone parcels in Arkansas are near rivers such as the Arkansas River, White River, or Ouachita River, and around low-lying areas near lakes or creeks.

Step-by-Step: How to Check If Your Land Is in a Flood Zone

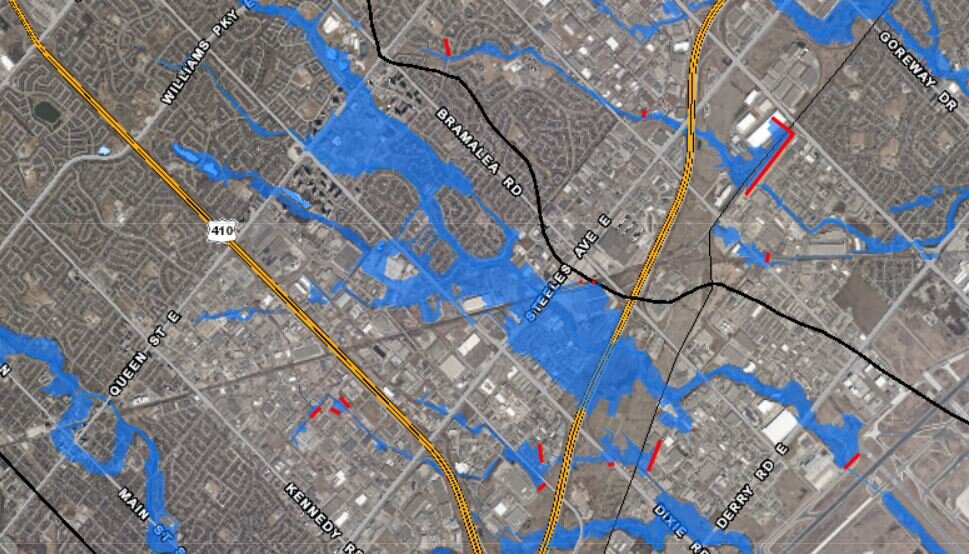

1. Use the FEMA Flood Map Service Center

Go to https://msc.fema.gov/portal/home.

- Enter your property address or coordinates.

- Click “View Map.”

- Look for colored areas over your parcel:

- Blue shading: flood zone (AE, A, AO, etc.)

- No shading: typically Zone X (minimal risk)

You can print or download a FIRMette — a small official section of the FEMA map showing your parcel’s flood designation.

2. Check County or City GIS Maps

Many Arkansas counties include flood-zone layers in their GIS mapping tools:

- Pulaski County GIS: pulaskicounty.net

- Benton County GIS: gis.bentoncountyar.gov

- Washington County GIS: washingtoncountyar.gov

Turn on the “FEMA Flood Layer” or “Hydrology” option to see if your land overlaps a floodplain.

3. Contact the County Planning or Engineering Office

If maps are unclear, your county planning office can confirm official flood status and explain base flood elevations (BFEs) or elevation certificate requirements.

4. Ask a Title Company or Surveyor

Title companies often check FEMA data as part of closing. A surveyor can also prepare an elevation certificate showing exactly how your land compares to flood levels — valuable if you want to prove your lot is above the floodplain.

How Flood-Zone Status Affects Selling

- Financing limitations: Buyers needing loans must carry flood insurance on high-risk lots.

- Insurance costs: Flood insurance can be expensive, reducing buyer demand.

- Disclosure: Sellers should always disclose known flood-zone status to avoid legal issues.

- Market value: Flood-zone properties often sell for 10–40% less than similar non-flood lots.

Still, many cash buyers (like Shamrock Lands) purchase flood-zone land for investment, recreational use, or future mitigation projects.

Tips for Selling Flood-Zone Land

- Gather information — include the FEMA map or flood certificate in your listing.

- Be transparent — buyers appreciate honesty; it speeds up closing.

- Price competitively — adjust for risk and insurance costs.

- Consider a cash buyer — avoids lender restrictions and long underwriting delays.

How Shamrock Lands Can Help

We routinely buy Arkansas parcels inside flood zones and handle:

- Title verification and flood-map research

- Closing costs and deed preparation

- Fast, cash closings through local title companies

You don’t need to fix drainage or raise the land. We purchase as-is, often within 15–21 days.

Conclusion

Knowing your flood-zone status protects you and helps set realistic expectations when selling. Use FEMA and county tools to confirm your parcel’s risk before listing.

If your land lies in a floodplain and traditional buyers hesitate, Shamrock Lands can make a fair, all-cash offer and handle the entire process for you.

📞 Call 501-406-0051

🌐 www.shamrocklands.com